36+ maximum deduction mortgage interest

Ad 10 Best Home Loan Lenders Compared Reviewed. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Find A Lender That Offers Great Service. Divide the cost of the points paid by the full term of the loan in.

Homeowners who bought houses before. Another itemized deduction is the SALT deduction which. Comparisons Trusted by 55000000.

Here is a simplified example with two instead of three mortgages. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Discover Helpful Information And Resources On Taxes From AARP.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You. Lets start with the mortgage from 2016 with an average balance of.

If you took out your home loan before Dec. Compare More Than Just Rates. Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. 30 x 12 360. Web Most homeowners can deduct all of their mortgage interest.

Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. Web Is mortgage interest tax deductible. Lock Your Rate Today.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness.

Web Yes of course. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web Mortgage Interest Deduction.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

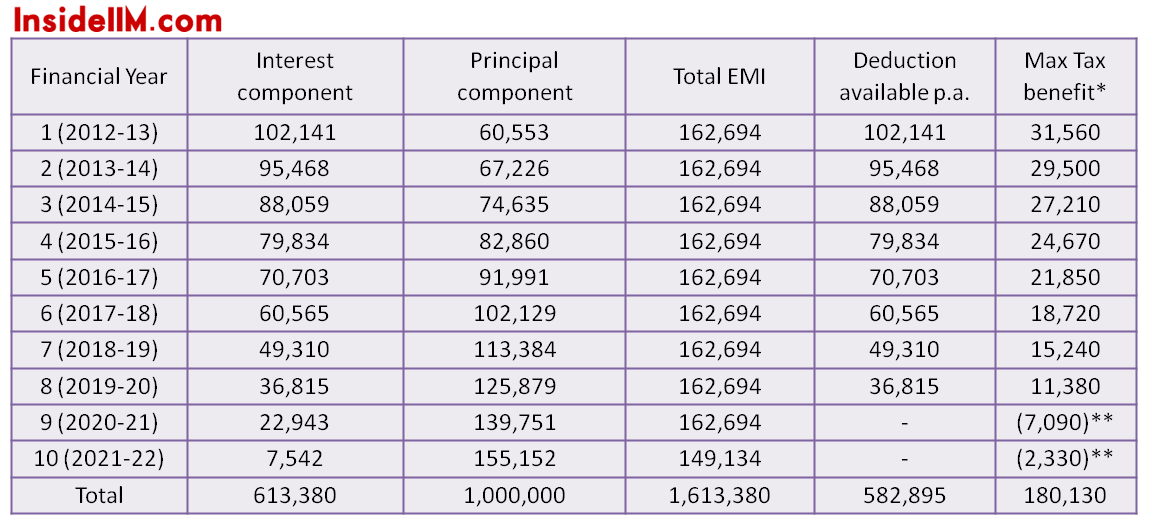

All You Need To Know About Tax Benefits On Education Loan Interest Payments Insideiim

Mortgage Interest Deduction How It Calculate Tax Savings

What Are The Possible Ways To Legally Save Income Tax For Salaried Person In India In 2022 Quora

Mortgage Interest Deduction Or Standard Deduction Houselogic

Deduction On Repayment Of House Loan Under Section 80c Simple Tax India

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Or Standard Deduction Houselogic

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Tax Deduction What You Need To Know

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Tax Deduction Smartasset Com

Deductions U S 36 Expenses Allowed For Deduction Tax2win

Mortgage Interest Deduction A Guide Rocket Mortgage

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect